Acct integrators assn dues on bank statements, a common sight for many businesses, represent membership fees paid to professional organizations. Understanding their nature, identification, accounting treatment, and management is crucial for accurate financial record-keeping and organizational compliance.

This guide provides a comprehensive overview of acct integrators assn dues on bank statements, empowering readers with the knowledge to effectively manage these expenses and ensure their accurate reflection in financial records.

Overview of Acct Integrators Assn Dues

Acct integrators assn dues are membership fees paid to professional organizations by accounting integrators. These dues provide access to a range of benefits, including continuing education opportunities, networking events, and industry resources.

Typical acct integrators assn dues vary depending on the organization and the level of membership. Common dues structures include annual fees, tiered fees based on company size or revenue, and special rates for students or new members.

Acct integrators assn dues are typically paid annually or semi-annually. Payment methods may include online payments, credit card, or check.

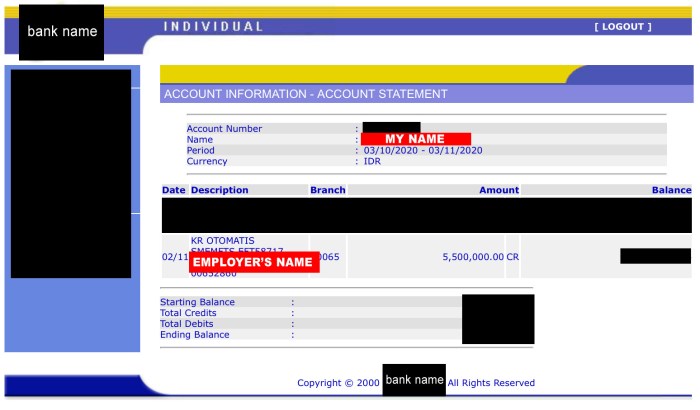

Identifying Acct Integrators Assn Dues on Bank Statements

Acct integrators assn dues may appear on bank statements with various descriptions or codes. Common descriptions include:

- Acct Integrators Assn Dues

- Membership Fee – Acct Integrators Assn

- AI Assn Dues

To distinguish acct integrators assn dues from other transactions, consider the following tips:

- Check the transaction amount against known dues rates.

- Review the transaction date to align with typical payment schedules.

- Look for recurring transactions with similar descriptions.

Regularly reviewing bank statements helps track acct integrators assn dues and ensure timely payments.

Accounting for Acct Integrators Assn Dues

Acct integrators assn dues are typically recorded as expenses in accounting systems. They may be classified as:

- Professional Development Expenses

- Membership Dues

- Other Expenses

For financial reporting purposes, acct integrators assn dues are usually reported as part of general and administrative expenses.

Tax implications of acct integrators assn dues vary depending on the jurisdiction and the nature of the organization. In some cases, dues may be tax-deductible as business expenses.

Managing Acct Integrators Assn Dues: Acct Integrators Assn Dues On Bank Statement

| Step | Description |

|---|---|

| 1 | Determine membership level and calculate dues. |

| 2 | Review payment options and deadlines. |

| 3 | Prepare and submit payment. |

| 4 | Reconcile bank statements and update accounting records. |

| 5 | Monitor dues payments and ensure timely renewal. |

Best practices for managing acct integrators assn dues include:

- Budgeting and forecasting dues expenses.

- Negotiating favorable payment terms with the organization.

- Exploring discounts or waivers for multiple-year memberships.

By following these strategies, accounting integrators can optimize their acct integrators assn dues expenses and maximize the value of their membership.

FAQ Guide

What are acct integrators assn dues?

Acct integrators assn dues are membership fees paid to professional organizations representing the accounting integration industry.

How can I identify acct integrators assn dues on my bank statement?

Look for descriptions or codes indicating “acct integrators assn dues” or similar.

How should acct integrators assn dues be recorded in accounting systems?

Typically, these dues are recorded as expenses in the “Professional Services” or “Membership Fees” category.